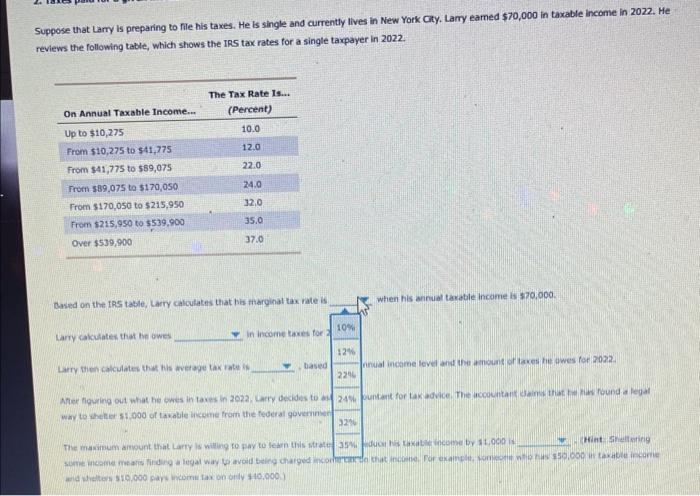

Brand new Contour illustrates brand new portion of users from the houses status for the

Graph 2

Notes: Adjusted prices. The brand new CES gathers with the fresh foundation extra data with the households’ houses condition in addition to homeowners’ home loan type in an effective specialized component on the homes avenues all February.

High rates of interest and you may inflation requirement

Very, what is the recognized relationship between consumers’ standard regarding the rising prices and you may the traditional on the interest levels? Questionnaire people whom anticipate seemingly large rates essentially including anticipate apparently higher rising cost of living pricing along the 2nd one-year (Graph 3). This suggests you to definitely customers never necessarily predict highest rates of interest during the a period of financial rules toning to lead to lessen rising prices, at least outside of the brief. You to potential cause for it self-confident organization would be the fact customers you are going to as well as anticipate lenders to boost interest levels to compensate having inflation inside their credit issues. A special it is possible to reason for this positive connection ‘s the character from rate-delicate mortgage payments, which have an impact to your consumers’ cost of living and boost its inflation traditional. To phrase it differently, high rate of interest requirement tends to be a source of wide issues in regards to the cost-of-living, which are in turn reflected inside the rising prices requirement. So it choice explanation is backed by the point that the good matchmaking anywhere between nominal interest criterion and you may rising cost of living expectations is actually strongest having customers just who keep a variable-rates home loan and are for this reason most confronted by changes in notice prices (Chart 3, red range).

Graph 3

Notes: Adjusted prices. The new Profile illustrates a binscatter area of the average meant imply off a beneficial beta shipping suited to consumers probabilistic predicts regarding inflation across the next 1 year (y-axis) against customers rate of interest requirement across the next one year (x-axis) considering pooled study. Each of the installing traces accounts for private fixed consequences and you may revolution dummies demonstrating thereby the inside-individual updating regarding criterion.

This new part of casing from the signal from monetary rules is along with reflected into the an increasing divergence in the way house understand the finances now compared to 1 year in the past according to the housing problem, specifically towards the nature of its home loan package. The fresh new display out of households one find its financial situation due to the fact weakening keeps gradually denied just like the rising prices enjoys dropped from the level when you look at the later 2022. Brand new CES study in addition to emphasize, not, you to consumers with adjustable-price mortgage loans are continuously more likely to see the financial affairs due to the fact getting even worse (lime range in Chart 4). Concurrently, particular houses have also not able to services the home loan repayments. When the amount of quick-label rates peaked in approximately fifteen% regarding varying-price financial people doing this new CES anticipated to become late the help of its mortgage payments over the next 1 year. So it contrasts greatly for the 5.8% out of fixed-rate home loan proprietors with the same presumption.

Graph 4

Notes: Adjusted estimates. Monthly, people are expected: Do you believe family is financially better off otherwise even worse from today than simply it absolutely was 12 months back? to the a scale away from Even more serious off, Quite bad out-of, About the same, Slightly what is needed for a title loan in Washington better off or Better from. Individuals are classified as the with a bad finances whenever they respond to having rather more serious from or quite worse regarding.

Within this blogs, we demonstrate that for the current monetary toning phase people adjusted their genuine interest rate traditional. We have evidence that toning out of economic coverage features come carried in a different way to different euro urban area homes, simply showing its divergent housing and you may home loan situation. Searching ahead, good resetting of interest with the repaired speed mortgages and that originated for the low-value interest several months would likely suggest a good postponed contractionary influence on euro city households at the currently prevailing attract costs. A close monitoring of houses ents for customers, also from contact lens of personal-level household research, contributes to all of our knowledge of this new constant financial transmission.