Discover applications set up for disabled people to let overcome the fresh new obstacles out of imperfect borrowing from the bank and you will limited resources

Most people which discover Personal Safety Handicap pros inquire if it is achievable to have their unique home, or if perhaps they will be caught renting for the rest of the lives. There are many preconceived impression on the people that discovered Public Protection Impairment being unable to qualify for home financing. This is simply not fundamentally the situation. A lot of people whom discovered Personal Defense Disability professionals can also be qualify so you’re able to buy property there try programs in position to simply help disabled people qualify for a mortgage. While you are receiving Societal Defense Handicap gurus and you also want buying property of your own, there are some things you need to know.

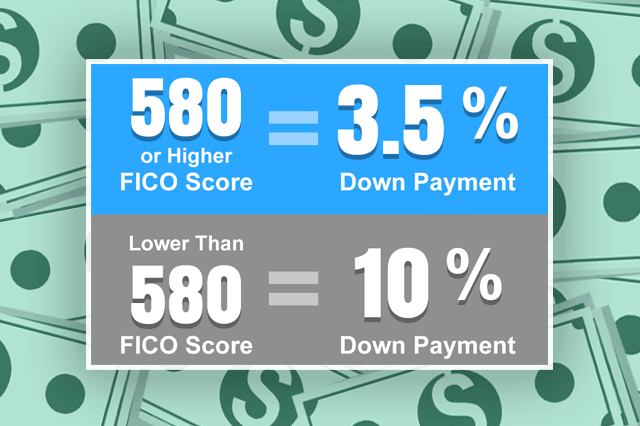

Long lasting sorts of financial youre obtaining, loan providers can look at your credit rating and you can money whenever deciding whether or not to accept you for a loan. That doesn’t mean, but not, that you will never be able to pick a property in the event the your credit rating try less than perfect or if perhaps your income is limited towards the Public Safeguards Disability gurus.

If you find yourself acquiring Public Protection Impairment gurus, discover software that will help purchase the house your you want. This new Federal national mortgage association Neighborhood HomeChoice program brings assist with handicapped individuals who want to get a property but have limited income. Federal national mortgage association can also provide you with a loan that may will let you make improvements to our home you buy in the event that people improvements try really related to your disabling status.

Other program that you may need to look into is Part 8. People believe that Point 8 assistance is just for renters, while in facts the program can also help you buy good house. If you qualify for Part 8 as well as your regional Area 8 workplace gets involved at home ownership system, you could receive direction for making the monthly mortgage repayments, while making home ownership less costly.

Habitat To possess Humanity is yet another program which can help people who located Personal Defense Impairment enjoy the great things about america cash loans Witches Woods owning a home. The application is actually geared towards reasonable-money parents and will be offering reasonable-attract mortgage loans between 7 to thirty years. Occasionally you really need to place sweating guarantee on acquisition of your home, but when you can not assistance with the building out of your home on account of an impairment you may be capable work out alternative agreements. Habitat to possess Mankind software is organized from the area level, thereby eligibility legislation can differ ranging from regional communities.

For folks who discovered Public Coverage Disability and you are capable qualify for home financing program, you happen to be concerned with coming up with this new downpayment towards acquisition of your property. Luckily for us, you can find creative resource possibilities in order to fulfill your own advance payment conditions.

Although your credit score possess sustained, your whenever searching Social Safety Handicap, dependent on your own Month-to-month Work for Amount (MBA)

The fresh Federal national mortgage association program mentioned before may need a deposit off as little as $five-hundred whenever you are receiving Personal Protection Disability. Some other apps you can consider work collateral solutions or if you may prefer to promote top dollar into home whether your vendor was prepared to gift brand new down payment.

They fear which they don’t have enough earnings otherwise one the reality that he is into the impairment rather than functioning commonly block off the road of qualifying having a mortgage

Whenever choosing Social Security Impairment, you are able to explore features otherwise gift ideas to suit your off percentage need. Particular apps, including the IDA system, enables you to spend less towards your deposit and certainly will fits area otherwise most of the money you add on the IDA account for usage on purchase of a home. Anytime, eg, you really have stored $step one,100000 from your own Personal Security Disability pros to your down payment, the latest coordinating present might possibly be $step one,100, providing a maximum of $dos,one hundred thousand to place down on your home get.

Whenever you are acquiring Personal Cover Impairment and also you must pick a house, you’ll find resources out there to get it done. Of numerous teams need certainly to let folks who are into Societal Shelter Disability read the fresh imagine owning a home. Check out the apps mentioned above and determine those you qualify for. If you use one of several applications to find a property, you can begin putting section of your own Societal Defense Impairment benefits for the getting your residence rather than placing rent in your landlord’s pocket.