Do i need to Rating a mortgage Versus Tax statements?

Most old-fashioned mortgages wanted taxation get back money verification for the past a couple of years to show earnings. However, there are many different period in which a borrower may not need to add tax statements.

Besides confidentiality, people only cannot show adequate yearly money to qualify for a mortgage on their certified taxation statements, especially if he or she is mind-employed or take multiple write-offs and you can providers deductions.

Mortgages To own Practical Wage Earners

Very non-salaried or hourly workers only need to complete W-2s otherwise spend stubs to ensure income to own home loan qualification. A loan provider may also want proof of employment one another at app and you will right before closing.

In the event you secure bonus shell out in the form of overtime or added bonus pay, a loan provider can sometimes have to find out if for the manager. Just in case you secure more 25% of the pay in income, tax returns may still be required.

Mortgage loans To possess Advertisers

Oftentimes, individuals who are entrepreneurs otherwise separate builders usually do not reveal enough income into yearly tax statements to be eligible for a normal home loan. In this situation, an entrepreneur may want to apply for a financial report home loan.

A series of just one so you can two years away from bank comments tend to supply the financial a peek out of monthly income that wont fundamentally getting shown into a taxation get back for anyone whom try self-operating.

Certification Conditions to own Bank Declaration Mortgages

- Self-a career – To apply for a bank statement mortgage, the newest borrower need to be notice-employed or an independent company, but will not always need to be the only real holder off the firm.

- Verification of your own organization’s lifetime – The organization need to have been in existence to have a time period of no less than a couple of years. The lending company will need confirmation of existence of your own business that have no less than one of one’s after the: a business checklist, a business licenses, a site, a keen accountant confirmation letter, 1099s, or any other verifying issues.

- Lender Report Criteria – Many lender report lenders requires one to two several years of financial statements to determine a full time income. Generally, month-to-month deposits is averaged, playing with one another places out-of individual levels including a share regarding places from organization accounts. A debtor can be required to show money way off the company checking account toward private savings account.

- Deposit Requirements – Additional loan issues have various other down-payment conditions. Even though some need only 10% deposit, it can often depend on the new borrower’s other variables, like credit ratings, money, money on give, or other possessions.

- Credit history Requirements – If you are credit rating standards vary away from financial so you can financial, really loan providers want to see a get off 600 or maybe more. Other requirements such as deposit will get improve otherwise fall off centered towards credit score of the debtor.

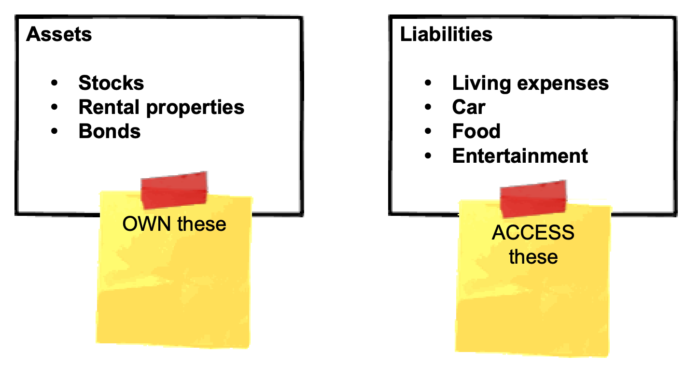

- Property – Underwriters are always in search of more economic items, called compensating situations, that make a debtor a glamorous degree risk. Extreme monetary assets try a powerful compensating component that create loans for undocumented immigrants a great debtor more desirable so you’re able to a lender.

- Possessions conditions – according to the bank, it is possible to invest in a primary house, 2nd house, or money spent from solitary-loved ones so you’re able to cuatro residential products. Cash-aside refinances are also available.

Rate of interest Details

As a lender plays greater risk with a lender declaration home loan that doesn’t want all the usual verification documentation, that it usually comes up regarding interest rate. Whilst every and each financial is different, you will be provided additional cost reliant your credit score or perhaps the level of their down-payment.

Concerns? I have Answers!

If you have more questions about non-being qualified mortgage issues, get in touch with the pros at the NonQMHomeLoans. We offer a standard a number of financial factors of antique so you’re able to individual individual mortgage loans.