How can i Explore a consumer loan to own Auto Fix Expenses?

When you’re on unfortunate status of obtaining to use a personal loan to solve the car and you may repair will set you back, it can be tough to discover the place to start. Luckily for us, you will find some locations where you ought to look for when given a loan for vehicles expenditures. When you’re running out of currency and need assistance with dollars, vehicles repair financing solutions shall be good starting point. Before you get started, yet not, you must know what things to pick in terms of your own mortgage.

There are bad credit short term loan various loan providers offering capital. Yet not, only some of them is legitimate, therefore need certainly to look for a company which is reliable just before your sign on the fresh new dotted line. You can do this by-doing some investigating to your one bank you are given. You may search for analysis on the internet from the particular loan providers that attract you. Including doing some search, it is very important end up being most particular whenever asking for an individual mortgage. This will help you find the best mortgage options that fit your circumstances. While some auto fix financing provide terms of six otherwise a dozen weeks, you should know wants lengthened terms. This will allow you to continue paying down the remaining obligations and enjoy lower rates along side lifetime of the borrowed funds.

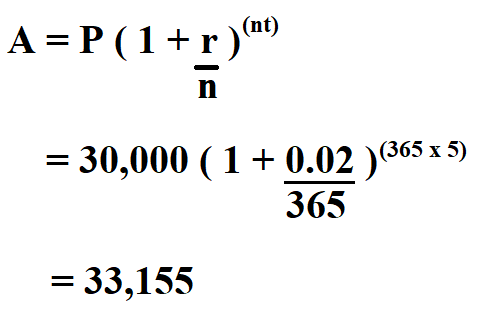

This can save the eye you to accrues toward mortgage count per month

If you’re able to find an extended-title loan, definitely generate complete payment preparations when paying down the loan dominating. It is quite important to know that you’re minimal to your value of your vehicle while the safety whenever making an application for vehicle fix finance . When you are there are many vehicle repair fund available, it is very important keep in mind that never assume all loan now offers lookup exactly exactly the same.

There are numerous lenders available to choose from who’ll help you with bucks when you need it really. You can find brand of funds which can be used to help you financing vehicles solutions, plus they include various other categories of advantages and disadvantages. Whether or not need a short-name loan or something that go longer, there is an option available to you for everyone. When looking for that loan, you need to make sure you enjoys a clear notion of what you are selecting. With respect to vehicle representative

In this instance, make certain you understand your own vehicle’s worthy of before finalizing a check out to the lender

Fundamentally, unsecured loans is actually much time-title financing agreements that provide your a lot of money and place terminology wherein you should repay the loan. The advantage of taking out fully an extended-name loan is that you can repay the whole loan over time. This can will let you maintain your interest rates reduced and allow you to prevent paying for months within the interest repayments.

Automobile security funds are specially readily available for users with bought a different car in the last two years. It provide bucks quickly to possess a fantastic mortgage equilibrium, but there is however a greater danger of attention increases because you consistently pay off the mortgage. Car security loans try brief-title financings giving consumers up to five years of great interest-100 % free capital. You might be considered for those who have not repaid your car get equilibrium otherwise associated debts within the last 2 years.

Cash advance are typically lowest-to-average interest financing which is often applied for for 5 days, and this ends up so you’re able to thirty-five % interest levels. You’ll then have to pay straight back the full amount of the loan immediately after it is accomplished. Such as a consumer loan, pay day loan features fixed terminology with no set restrict for the whenever you have to make repayments.

A secured financing are that loan that you remove getting auto fix expenses that’s protected because of the worth of the vehicles. This is why in place of taking out fully that loan regarding a good bank, you can aquire the money from the automobile’s insurance company rather. One to benefit to this process is the fact that price of restoring your car is just a highly small part of your complete cost of employing an insurance coverage business. In the bulk away from cases, a secured automobile repair financing can cost you significantly less within the attract than a basic mortgage. Along with, just like the insurers are acclimatized to making reference to automobiles and you may vehicle repair, he could be some of the best loan providers to do business with whenever considering taking dollars.

when you are wanting an individual car repair mortgage, it’s important to be aware of the difference in different varieties of finance. You shouldn’t be afraid to ask the lender whatever they usually feel willing to financing in advance of giving them hardly any money. The greater do you know what you’re getting to your, the more likely your chances of success would be.

Information and you will website links are given for standard suggestions objectives merely and should not be construed due to the fact economic information otherwise an endorsement so you can strongly recommend any service.