How to build borrowing from the bank because the a-stay-at-domestic mother

Getting a daddy was a difficult, daunting and you can fascinating time in your lifetime. Discover a great deal to set up having and will also be balancing many other jobs, and additionally caregiver and provider. Whether or not you decide to end up being a-stay-at-domestic mother or father, or it becomes the best option for your needs during the particular year from life, you’re curious how to continue steadily to maintain and you can build your borrowing.

While doing work part-for you personally to earn money is an alternative-such as for instance flexible secluded jobs-it isn’t necessarily attainable for everyone, specifically having an infant. In this post, you will observe in the particular methods consistently create credit due to the fact a stay-at-household moms and dad.

An easy way to generate borrowing from the bank without an income

Since an alternative father or mother, there are plenty of things would need to compromise, not to mention, a great deal that you’ll acquire- not, your own borrowing from the bank need not be one of the issues that suffers. Here are a few ways you can continue to make borrowing from the bank due to the fact a-stay-at-home mother versus a living.

End up being a third party representative

A proven way you might always build credit since the a-stay-at-house father or mother instead a living is to end up being an authorized member. Such, if your lover is operating, they may incorporate your as the a 3rd party affiliate on their borrowing from the bank cards. This would allows you to use the card as if it have been your own. The main account proprietor (in this instance, your partner) create nevertheless be guilty of putting some money, however your label might also be with the membership and provide your that have a way to create credit. Just how which works is that the credit history of the cards is the credit history on the credit history for as long since you are still a third party user.

Keep in mind when you are consider the options that, as a 3rd party associate, your own borrowing might have to go 1 of 2 ways. It could improve your credit (in case your top cards manager is in control which have and come up with its month-to-month payments) otherwise damage the borrowing from the bank (in case the primary credit proprietor is actually irresponsible and you will defaults). As a third party associate, their borrowing from the bank is influenced by an important cards holder’s choices since they pertains to its credit, costs and you may financial management.

Consider utilizing compatible credit cards

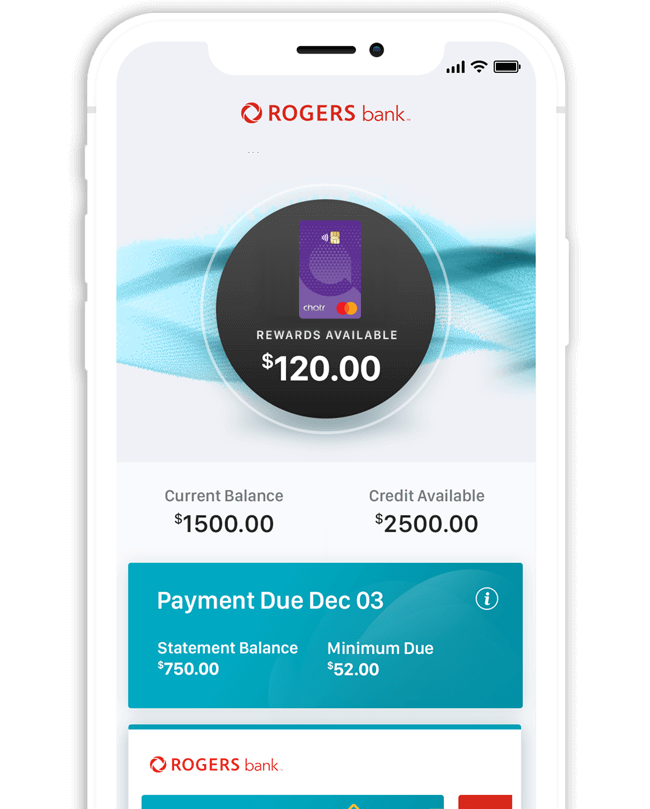

Even if you lack a constant earnings, you can continue using their handmade cards with techniques you to definitely benefit you. Including playing with handmade cards that provide benefits to possess factors particularly food, energy and you can dining. With increasing children, possible undoubtedly getting to make reoccurring purchases which could potentially sound right to make you perks, discounts and other advantages.

This type of notes can include store handmade cards (specific so you’re able to a certain shop or chain from locations inside an excellent network) otherwise credit cards that may come with particular advantages or straight down annual payment rates (APRs).

Play with free products such Chase Borrowing Excursion to help you

Having a baby setting plenty of extra expenditures-you’re probably wishing to cut can cost you if at all possible otherwise is actually thinking how to keep the credit history amidst all brand new expenditures. Consider using online equipment for example Borrowing Trip installment loans no credit check Charlotte MI in order to monitor and you may probably alter your credit history. You can purchase a customized package available with Experian so you’re able to exercise adjust their get with the intention that its when you look at the an excellent condition ahead of and you can throughout parenthood.

- Located a totally free, current credit history as often since the 7 days

- Display screen and you can track your credit rating through the years

- Join borrowing from the bank keeping track of and you will term keeping track of notice to keep your data secure

- Control free informative tips to aid top see your credit rating

- Make use of the credit thought ability to help you map out their future credit history

Place resources or any other qualities on the name and you will pay them per month

Whether you are creating income out of another resource or revealing their partner’s earnings to fund expense, lay bills and you will repeated expenses under your label to build enhance fee records and rehearse a charge card to expend all of them off. But ensure so you’re able to finances carefully of these particular repeating expenditures.

Percentage background try a major factor that becomes noticed when calculating your credit score. Building up a powerful, uniform payment background can assist you to build credit as a good stay-at-family mother. While you’re to make your payments on time, this is a very good way to simply help alter your borrowing from the bank get throughout the years.

Unlock a combined account along with your mate/companion

If for example the partner is providing an income source and you may requires away a loan, believe having your name detailed near to theirs. Opening a shared account along with your companion (such an auto loan) can help broaden your accounts, that can improve your credit blend. This will help you get dependability on the attention out-of loan providers which help build a more powerful credit rating through the years.

Strengthening borrowing from the bank given that a single mother in the home

Whenever you are an individual, stay-at-home-father or mother, it may not getting feasible accomplish all of the above. You can even think considering one form of government pros that may apply at your.

When you are impression overwhelmed or puzzled, make sure to get in touch with the individuals which love your getting support. Mention some alternatives having household members up until the baby will come therefore you can have an agenda set up, such as for example that will assist observe your child even though you really works.

To close out

As a pops is a fantastic day, and also the last thing you want to love because you plan parenthood is the state of your credit rating. You could avoid worrying about precisely how your credit score has been doing by existence hands-on and you may diligent, causing you to be additional time to a target your youngster.