Latest Home loan Costs Always Are Below six.20%

Kacie was a self-employed contributor to Newsweek’s individual funds cluster. During the last a decade, she is developed their unique experience with the non-public loans room creating to possess guides such CNET, Bankrate, MSN, The straightforward Buck, Google, accounting firms, insurance firms and a residential property broker agents. She depending and you will runs their marketing posts and you can copywriting agency, Jot Articles, regarding her house into the Ventura, Ca.

Claire is an elderly editor from the Newsweek worried about playing cards, fund and you may banking. Their particular top priority is offering objective, in-breadth personal loans blogs to be certain website subscribers are well-equipped with degree when making financial choices.

Ahead of Newsweek, Claire invested five years during the Bankrate as a contribute handmade cards publisher. You’ll find their exercising because of Austin, Tx, otherwise great post to read to tackle website visitors within her spare time.

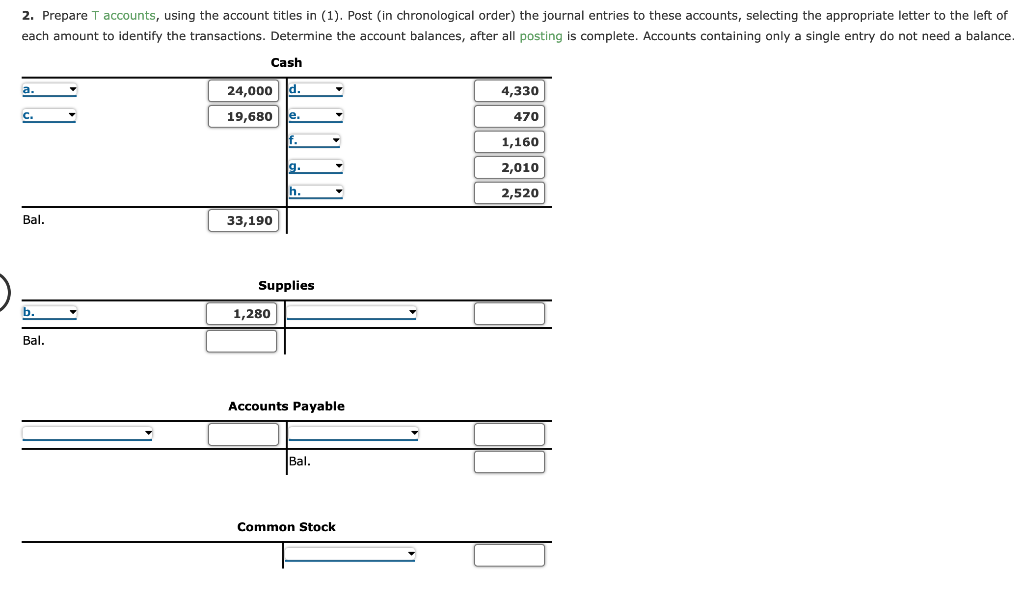

Homeowners always keep a near eyes on the financial costs, hoping for a fall which will straight down borrowing from the bank can cost you. Even though pricing peaked last year, current studies suggests just small declines, that have prices hanging up to 6.5%. People face a challenging business in which affordability remains a concern, even as costs show signs of stabilization. Be mindful of home loan rates even as we method new Sep Provided Conference, which may give a lot of time-awaited price incisions.

The modern average financial rates to the a 30-seasons repaired-price home loan, the best financial, are 6.23% , an effective eight basis factors jump about earlier in the day times. Consumers wanting a smaller benefits vista that have fifteen-year repaired mortgage loans face an average speed of five.42 %, a drop of just one foundation points away from yesterday. To have consumers selecting protected bodies financing due to their dream house, 30-season repaired FHA mortgage loans average 6.03 %, compared to 6.32 % the latest month past.

Reputable Rates Away from Container

Please be aware your home loan cost detailed was direct at the time of the latest time regarding publication. Because the monetary cost normally vary, the current cost may differ. We strive so you’re able to update all of our research regularly so you can mirror this type of changes. In regards to our complete methods, excite reference brand new methods area after this new article.

Vault’s Advice: Mortgage Rate Globe Trend

Average rates hovering around 6.5% you are going to be humdrum compared to the sub-3% we spotted inside later 2020 and you may early 2021. However it is plenty a lot better than it may be. A beneficial zoom-out demonstrates average financial interest rates topped 18% during the 1981.

A go through the Housing industry

Also modified getting inflation, households have been way more sensible in the 1980s. In fact, we now have viewed home prices increase over the past while.

Brand new pandemic drove a heightened need for steady construction paired with big supply chain interruptions. Thus, for the 2021, the outcome-Shiller U.S. Federal Family Rates Directory jumped 18.6%. That is the greatest solitary-12 months growth one list features measured because it come recording home cost into the 1987.

It’s no wonder that the profit away from established homes has had a knock. This new NAR accounts present household conversion process have fell out-of an optimum off 6,600,600 a month during the early 2021 to just step 3,890,000 since is actually the newest slowest seasons having house sales since 1995.

And also as of your midpoint from inside the 2024, domestic conversion were still popular downwards. We have achieved the point at which benefits are in fact anticipating good changeover out-of a seller’s market to one that favors consumers.

However, anywhere between high home prices and you can high home loan rates (versus history several years), of several create-be homeowners have been would love to rating dedicated to interested in its new house. Plus the disease isn’t really probably transform any time soon-at least so far as costs are involved.

Federal Reserve Rates and you may Financial Prices

Mortgage rates carrying apparently constant within the last a couple of years is traced returning to the brand new Federal Reserve. Given that country’s main bank will not physically lay home loan costs, it will may play a role.