Most of the Unmarried Mothers: cuatro An effective way to Generate Homeownership A reality

Anywhere between powering a family group, doing work, and you will caring for your children, the notion of to buy a home because the a single moms and dad you will appear daunting to start with. However in truth, it’s no diverse from to purchase property less than another affairs. Actually, you could be eligible for a great deal more if you disclose your own youngster service or alimony payments because an income source. Every real estate excursion is different so when a single moms and dad, there are certain information and methods that will help toward the right path in order to homeownership. Here’s what try keeping better away from notice so that you may have a soft financial process:

step one. Construct your savings

To order a house because the just one parent ensures that within the prices is perfectly up to your. Among the best ways you can ready yourself is via protecting if you can. Appears style of noticeable, however, lowering to your so many costs otherwise seeking an easy way to earn a little extra dollars can somewhat release currency for your this new household – anything of numerous homebuyers cannot consider.

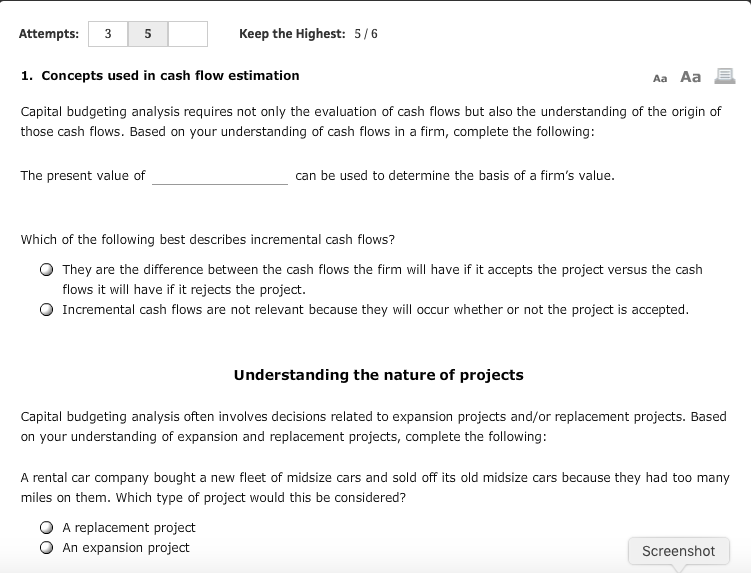

It’s usually a good idea to set-out at the least 5% percent of your amount borrowed, 20% when you need to end individual financial insurance rates, and draw regarding offers is going to be a sensible way to coverage you to definitely prices. Remember, some mortgage software, particularly FHA, USDA, or Virtual assistant loans, keeps additional deposit requirements, so you may manage to lay out notably less.

When you have questions regarding advance payment conditions or perform wish to can help save getting a down-payment, confer with your home loan banker. County and you may state houses companies often bring advance payment guidelines software and are usually worth looking at if you require some assist. The sort of assist provided by these types of divisions may vary because of the area, state, and you can condition, but are usually subject to earnings criteria. They are usually meant to assist parents having lowest-to-modest income gain access to reasonable down-payment solutions. Due to the fact more section have various other average money profile, this new restrictions may vary drastically based on where you happen to live.

Your own Nest egg Can help Safeguards More Will set you back

An excellent downpayment makes it possible to end most costs instance personal home loan insurance (PMI) and relieve the monthly premiums, while i temporarily listed above. You’ll be able to make use of your offers to cover other homeowner expenses such as fees, swinging expenses, disaster repair and repairs, otherwise closing costs.

dos. Get your borrowing from the bank and you can qualification ducks in a row

Financial qualification utilizes a few different factors. For the very best loan easy for your, it assists to spend attention for the credit history and then have your money on better contour you’ll.

Reduce Debt

The degree of obligations which you installment loans Denver CO hold may affect your own certification, therefore it is a good idea to pay it down just that you can before you apply getting home financing. Lenders will always check your [debt-to-money ratio DTI by the measuring your debts up against just how much you earn.

Usually Your credit rating

Obtaining the large credit rating you’ll can cause huge discounts along the longevity of the loan. The greater your own rating, the more likely you’re going to get a reduced interest rate, which leads to a reduced payment per month.

Credit rating requirements can differ away from lender to help you financial, your Atlantic Bay mortgage banker can be answer all your valuable questions that assist you notice a knowledgeable choices to suit your demands.

Prepare your A career Record

Your work record and you will earnings can both factor to your financial certification. You are questioned to submit records to assist ensure and you can statement your earnings, making it best prepare your information ahead of time. It is also likely that your boss must provide a career or income verification, very remain that planned before you go to try to get your home loan. For those who have questions regarding verifications otherwise degree requirements, their Atlantic Bay home loan banker is a great resource.