New underwriter will remark your posts and offer conditional and/otherwise last recognition to suit your new mortgage

The next step about re-finance processes is going as a result of an excellent domestic assessment and you will underwriting. Your bank tend to buy a different sort of home assessment to confirm the newest house well worth.

Underwriting turn times can differ widely. Specific loan providers can be underwrite a refinance loan into the months, although some usually takes a couple weeks. The amount of time underwriting requires depends on an excellent lender’s latest volume, the brand new complexity of one’s software, and also the way to obtain appraisers. An appraisal alone can often get 1 to 2 weeks.

Because the debtor, it a portion of the refinance techniques is generally a waiting online game. But you can usually reduce new approval go out by giving all the your write-ups straight away and giving an answer to extra needs as easily as you are able to.

six. Closure big date

When refinancing, you will come across the fresh Best regarding Rescission. This really is a mandatory about three-date wishing several months ahead of your loan loan places San Acacio commonly money. It gives homeowners a little windows in which they may be able cancel their refinance mortgage once they change the thoughts.

Considering you choose to go to come together with your mortgage, you should have an ending big date and signal the very last records, identical to in your first mortgage. To be sure their closure day is just as easy as you are able to, consider the following the steps:

- Remain in romantic contact with your financial regarding days best up to the new closure. This helps make sure all of the necessary documents and you may monetary preparations toward home loan are in place

- Feel such as for example cautious to not ever get most credit or use playing cards more than common

- Underwriters generally speaking check your credit file again prior to settlement. Guarantee that to help keep your credit profile as close as you are able to to the way it is actually when you applied for the loan

Nowadays, loan providers have to issue an ending Revelation (CD) in this 3 days out-of closing. The pace, terminology, and you will closing costs on the Computer game will be closely echo the people on your own Financing Imagine. Home loan borrowers is to contrast the mortgage Estimate and the Closing Disclosure for all the errors. You will need to feedback these types of documents meticulously together with your bank.

Great things about mortgage refinancing

It is important to see debt requires whenever refinancing. Check out situations where it’s a good idea to take on refinancing your residence.

- Cancel home loan insurance rates: Very antique loan holders is lose private mortgage insurance rates (PMI) after they reach 20% family collateral. But FHA individuals aren’t so happy. They’ll spend home loan insurance costs (MIP) before the mortgage are paid off otherwise refinanced on an alternate financing sorts of

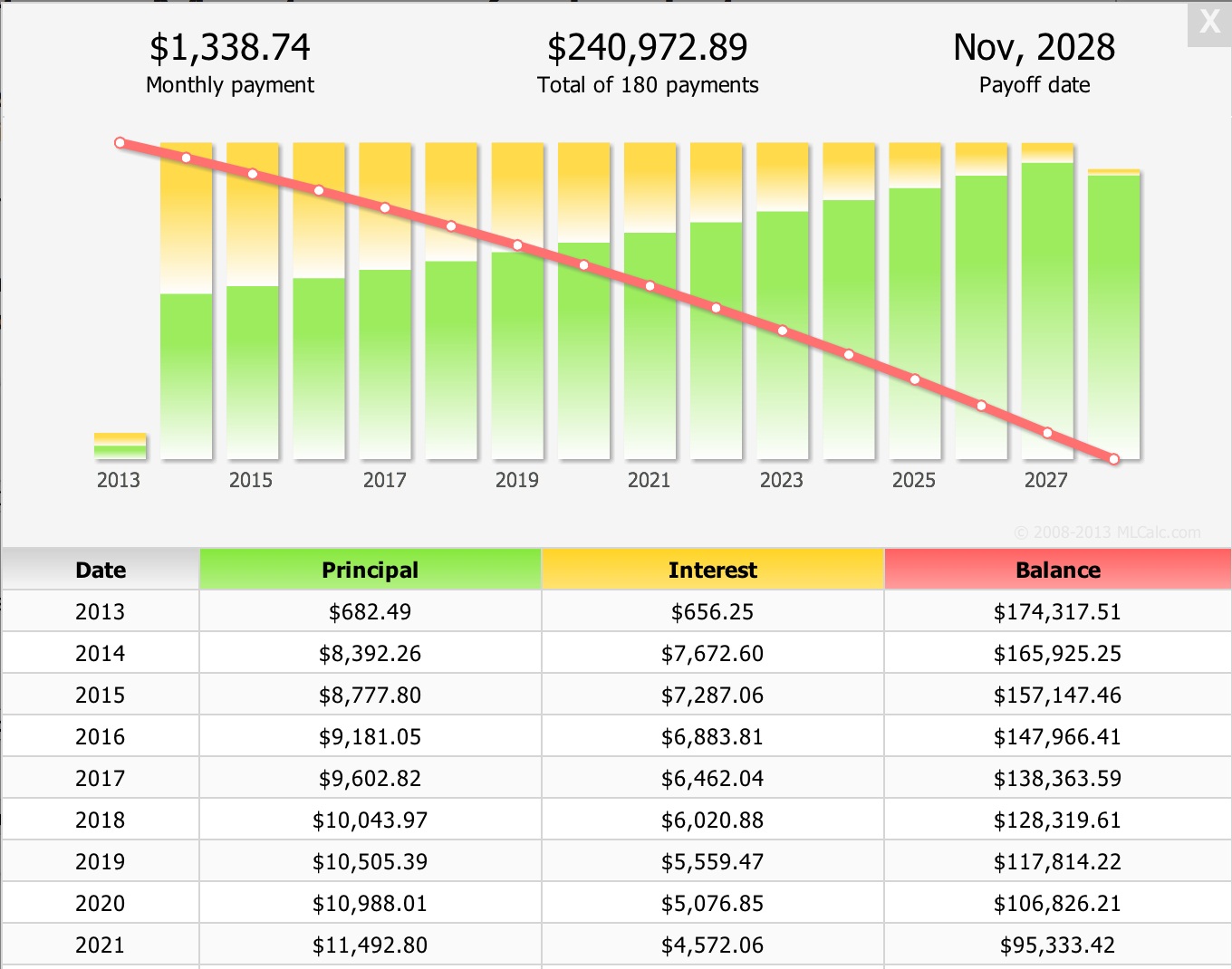

- Very own your home in the course of time: Property owners whom re-finance its 31-year loan to the a good 15-12 months mortgage commonly own their homes outright much ultimately. And, if you can get it done with a diminished interest rate, then deals could be extreme

- Lower your homeloan payment: When you find yourself lucky enough so you can score a lower life expectancy price having a beneficial brand new home loan, then you might decrease your monthly bucks criteria

- Tap household guarantee: Cash-out refinances is a well-known means for accessing the home’s guarantee. You can use the brand new lump sum payment for objective, and additionally to buy resource features, do it yourself, otherwise debt consolidation reduction

Downsides of refinancing a mortgage

Mortgage refinancing financing cannot constantly build economic experience. Some residents might end upwards using extra cash within the fees and desire. Check out reasons refinancing may well not sound right for you.

- You can easily shell out closing costs once again: Underwriting a mortgage isn’t really cheaper. Like your home buy, expect to pay dos% so you can 6% of loan amount in closing costs

- Borrowing will set you back can increase: Your brand new mortgage ple, for individuals who re-finance your 29-12 months financing to your an alternate 30-year mortgage, you will likely pay way more notice than simply if you hadn’t prolonged your mortgage installment name