Qualification Standards to own USDA Loan Lafayette Los angeles

If you’re looking to purchase a home into the a rural area and you will mention investment solutions that have positive terminology, USDA financing shall be an effective choices.

In this post, we will take you step-by-step through advantages, eligibility standards, application techniques, and you can dependence on Rural Development in Lafayette, Louisiana.

Insights USDA Loan Lafayette, Los angeles

The us Agencies regarding Agriculture now offers mortgage applications backed by USDA money, labeled as Outlying Advancement loans. He is designed to help homebuyers inside rural and you will suburban portion through providing affordable investment with lower-interest rates and flexible eligibility paydayloanalabama.com/tibbie/ conditions.

Great things about USDA Mortgage Lafayette, La

- 100% Financing: USDA fund succeed capital for the whole household purchase price, getting rid of the necessity for a deposit. This makes homeownership even more attainable for the majority of people from inside the Lafayette.

- Competitive Rates: Which have USDA money, consumers can also enjoy aggressive interest rates which might be often below conventional finance. Lower rates of interest convert to lower monthly home loan repayments, taking possible savings over the life of the loan.

- Flexible Borrowing from the bank Conditions: USDA financing have flexible borrowing standards, making them accessible to those with quicker-than-best borrowing from the bank records. Even though you have acquired credit pressures before, you may still be eligible for a great USDA financing into the Lafayette.

You can enjoy the great benefits of homeownership without the weight away from a deposit, while also taking advantage of lower monthly payments and you may deeper liberty in borrowing from the bank conditions

Rural Creativity Financing within the Lafayette, La

The significance of Rural Innovation: Rural advancement plays a crucial role when you look at the Lafayette, Los angeles, and its nearby areas. They targets improving the total well being, infrastructure, and economic solutions inside rural communities.

- USDA Loans for the Lafayette: USDA finance was part of the fresh rural creativity services into the Lafayette. Giving affordable resource alternatives, these money subscribe to the development and you can stability off rural communities in your neighborhood. It trigger economic hobby, foster neighborhood invention, and give use of safe and affordable houses.

Becoming qualified to receive good USDA financing in Lafayette, you ought to meet specific standards. Here you will find the trick standards:

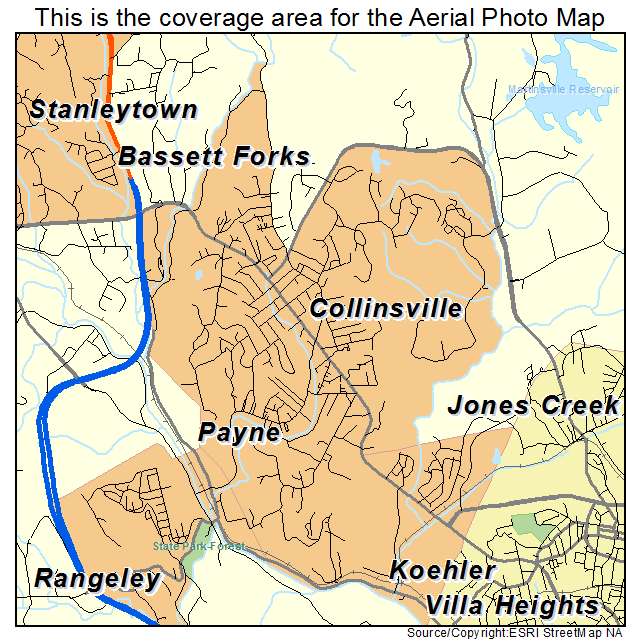

- Assets Area: The house you want to pick need to be situated in an enthusiastic eligible outlying or residential district city. You might dictate the fresh new property’s qualifications by speaking about the fresh USDA qualification map otherwise consulting a loan provider always USDA loans.

- Earnings Constraints: USDA loans has actually earnings constraints based on the measurements of your home therefore the location of the assets. Its imperative to opinion the current money constraints place by USDA to choose the eligibility. This type of limitations make certain that USDA finance is directed into the anybody and you can household with modest to reduced earnings.

- Property Standards: The property need certainly to see specific safety, habitability, and you will cleanliness requirements situated by the USDA. A professional professional conducts an appraisal to test such standards. It means that the property will bring a secure and you will compatible lifestyle ecosystem.

Fulfilling this type of requirements is important so you can qualifying for an effective USDA mortgage from inside the Lafayette. Making certain that the property is within a qualified area, your revenue falls into the given constraints, in addition to assets meets the desired standards increases the probability away from protecting a USDA mortgage. \

Obtaining a rural Development Mortgage inside the Lafayette, La

- Seeking an effective USDA-Recognized Lender: To apply for good USDA financing inside the Lafayette, you will have to get a hold of a good USDA-recognized lender experienced with these types of financing. They understand the particular standards and records necessary for USDA mortgage programs.

- Event Paperwork: Before applying, assemble required documentation such as for example evidence of income, credit rating, a job records, resource advice, and you will identification.