Simple tips to Sign up for an effective Huntington Bank Personal loan?

Customizable Terminology. Huntington Lender brings personalized financing terminology which might be designed in order to match private monetary things, making it possible for consumers to obtain a payment bundle that fits its finances.

On the web Account Administration. Users is also easily would its personal bank loan membership online, enabling these to glance at balance, track purchases, and come up with repayments easily.

Quick access so you’re able to Money. Huntington Lender also provides immediate access so you can money, making it possible for individuals to get their funds timely and employ it to possess the implied intentions.

Qualifications Conditions. Like most financial institution, Huntington Bank possess certain qualification requirements private money, rather than all people ount otherwise terminology.

Equity Requirements. Secured loans regarding Huntington Lender want guarantee, meaning consumers have to hope property since the safeguards. It isn’t really feasible for anyone that will maximum borrowing from the bank selection.

Creditworthiness Considerations. Creditworthiness takes on a life threatening part when you look at the mortgage acceptance and you can interest rates. Individuals with faster-than-prime borrowing histories may deal with demands for the securing favorable mortgage conditions or may be provided higher interest rates.

Minimal Access. Huntington Bank’s personal loans are only obtainable in 11 claims in which the lending company currently features an exposure: Kansas, Illinois, Indiana, Kentucky, Michigan, Pennsylvania, Western Virginia, Wisconsin, Minnesota, Southern Dakota, and you can Tx. This restricted access can get restrict availableness having potential individuals residing exterior these states.

To be certain a softer application techniques to own an unsecured loan, it’s always best to check out the called for files in advance. You’ll be able to get in touch with the fresh lending where can i get a personal loan with bad credit in Chicago cardiovascular system within +step one (800) 628-7076 otherwise reach out to neighborhood branch getting personalized guidance to your particular records you’ll need for the application.

Requirements

- Societal Security or Taxpayer Character Matter. Which identification is important to possess guaranteeing your own identity and you can conforming that have regulating conditions.

- Individual personality. Appropriate character data files, such as a driver’s license otherwise passport, might be needed seriously to present your own term.

- Income suggestions. Paperwork reflecting your revenue, eg pay stubs, taxation statements, otherwise lender statements, will be required to assess debt ability to pay the mortgage.

- A position record. Information on your a position history, together with your employer’s identity, work status, and you will time of a job, are generally requested to check your own balances and you will ability to satisfy cost personal debt.

A means to Have the Currency

Just after Huntington Bank approves your own personal loan application, the financial institution usually generally speaking disburse the loan add up to your courtesy an approach to your choice. Here are the common actions Huntington Financial ount.

Lead Deposit. Huntington Financial can also be import the loan finance into your designated checking account. This process now offers comfort and allows immediate access into funds.

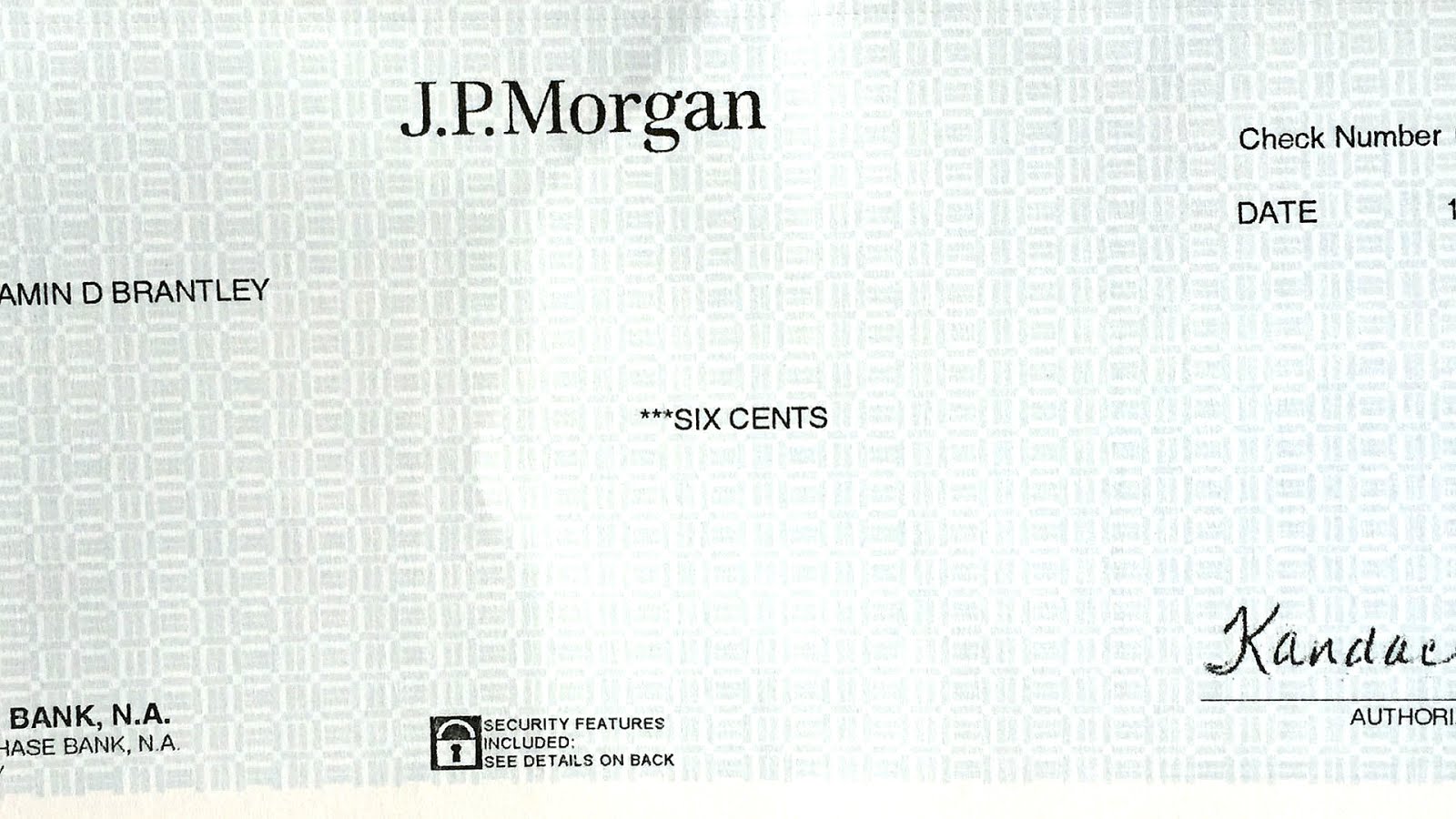

Consider. The financial institution ount, that will be sent towards the registered address. Then you can deposit or bucks the fresh evaluate as per the liking.

Move into Huntington Savings account. When you yourself have an existing Huntington Family savings, the borrowed funds money will be transported into you to account.

Tips Pay off an effective Huntington Financial Consumer loan?

When your personal loan application is accepted, you might be granted a lump sum. Next, you are going to repay the borrowed funds more a selected period compliment of uniform repaired repayments and you will a fixed interest rate.

Facts to consider

- Financing Conditions. Huntington Financial gives the self-reliance regarding around three- or five-12 months words because of their personal loans, enabling individuals to choose the repayment months that meets their demands.

- Fees. Take advantage of the advantage of no app otherwise prepayment costs whenever acquiring a consumer loan of Huntington Financial. That it assures a transparent borrowing feel without any additional charges.

- Restricted Accessibility. It is very important note that Huntington Bank’s unsecured loans are only available during the eleven claims where in actuality the bank enjoys an exposure: Kansas, Illinois, Indiana, Kentucky, Michigan, Pennsylvania, Western Virginia, Wisconsin, Minnesota, Southern Dakota, and Texas. This geographic restrict get maximum availableness for individuals living outside this type of states.