Step-by-Step Help guide to Protecting a residential property Mortgage

The most important thing at this time should be to know what numerous kinds off loan providers find, and you may what forms of mortgage choices are readily available.

Step one obtaining an investment property mortgage is always to understand the money you owe along with your official certification. To accomplish this you should:

- Check your private credit scores together with the major credit agencies.

- Remark your own yearly income. When you have a Penton AL pay day loans position look at your W-2s and you can W-9s the past couple of years.

- See the debt-to-earnings ratio (DTI). What are the monthly loans costs and how would it compare to the money?

- What kind of cash are you experiencing for a downpayment? How quickly could you availableness that cash if you learn this new best assets?

You may want to talk to a talented lending company just who understands investment property money options to score prequalified for a loan (if the appropriate).

The next thing is to obtain the possessions we wish to get. This is quick otherwise slow, according to industry, just how much you can afford in order to borrow, or other factors. During the an aggressive business, you’re contending with cash buyers, therefore you’ll need to be prepared to work easily. This is why making the effort to research options and you can communicate with loan providers can be helpful, to confidently generate a deal which you are able to likely be able to find that loan to buy.

Simple tips to Submit an application for a residential property Financing

It could take time for you submit the application, so assemble one required guidance and you will papers beforehand. You may need to give taxation statements and you can financial comments as the better because details about your online business.

Shortly after you happen to be approved, you will end up provided that loan arrangement that listings loan terms and conditions, together with your financial rate. For many who accept, signal new records and the finance would be placed into the family savings.

What to Envision Prior to purchasing a residential property

You will find that signal above all to look at if you are trying undertake a residential property: Make certain you can afford the house or property you might be seeking get. From the real estate industry, many consumers explore what is actually known as 1% signal to decide just how much you are going to need to charges inside month-to-month rent making a reasonable earnings. New step one% rule needs first mathematics: Multiply the entire price by the 1% to find the month-to-month rent you’ll need to charge. Such as for instance, if the price is $200,000, you’re going to have to fees $2,000 monthly inside the rent. The newest rent number must be around the median rent pricing in your area or you may not be ready to find quality renters.

The fresh 50% rule suggests that 50% of the earnings away from book will go towards expenses. In the event that financing cost demands a critical amount of the earnings, it might be tough to make an effective money when you spend almost every other expenditures instance property fees, solutions, insurance rates, maintenance, property administration, etcetera.

All financing even offers commonly composed equal, so be sure to comparison shop because you will discover a beneficial better rates and conditions somewhere else. Your own expected deposit may differ considerably from financial to bank. Including, look for all fees which go to your money spent loan, as you may has actually origination and you may/otherwise administrative fees. As well, think can cost you away from managing the possessions to possess such things as basic and you can unforeseen repairs, insurance, and you will property fees.

Tips Leverage Money spent Financing for optimum Roi

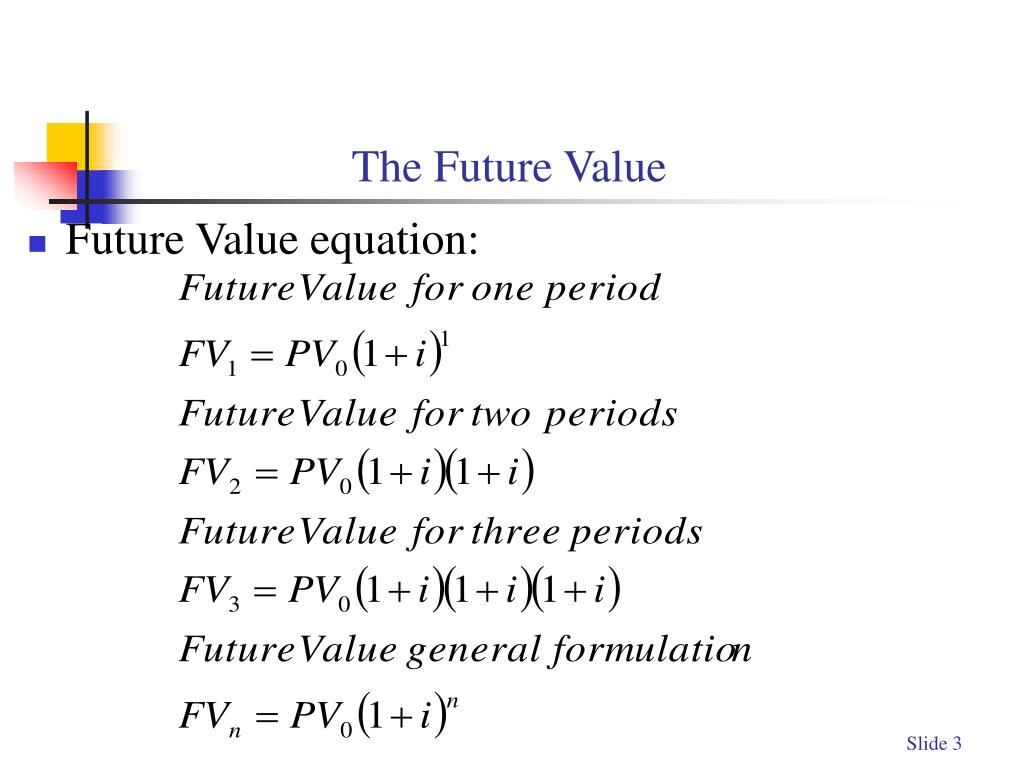

Leverage ‘s the concept of playing with Other’s Currency otherwise OPM to acquire assets. You employ a loan to finance an element of the pick, hence cuts back your aside-of-pocket costs.