Stop non-native stamp duty surcharge because a 457 charge manager

The greater loan providers you be considered having, the better all of our negotiating energy inside the saving you many having a great home loan you to definitely is best suited for your needs.

End FIRB acceptance

When you get your Publicity, otherwise get married someone who has it, you can steer clear of the pricing and problem for the authorities approval techniques.

Not as much as a government relocate to curb low-citizen using, temporary people and you may 457 visa people planning purchase land in the The brand new Southern Wales, Queensland or Victoria would have to pay an excellent stamp duty surcharge.

New surcharge may vary anywhere between step three% so you can 7% of your land value according to the condition and certainly will put tens of thousands of dollars on the purchase

However, you may avoid the surcharge if you purchase throughout the title away from an enthusiastic Australian resident less than a beneficial spousal visa arrangement.

Your merely other option is to simply buy in a state otherwise area that doesn’t apply a surcharge. Right now even in the event, the sole several towns and cities try Tasmania and you will North Area which means that your to acquire choices are limited.

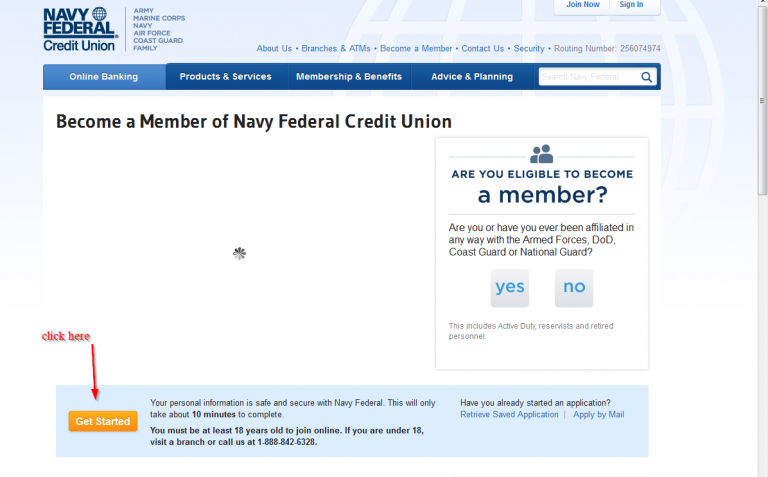

Let us help you to get recognized!

In australia, lenders is paid back by the financial to possess launching financing, to make the most of various loans off over 40 lenders without one costing you a penny!

Our company is mortgage brokers just who specialize within the lending to the people staying in Australian continent to your a 457 visa or other form of really works visa and certainly will rapidly pick you the most suitable mortgage.

If you need a mortgage, communicate with us toward 1300 889 743 or complete all of our free analysis function so we makes it possible to together with your loan application.

Did you know you will find generated unique arrangements having Australian lenders helping me to obtain loan approvals to have international citizens life around australia? Even when the bank otherwise mortgage broker possess denied your application, please e mail us!

Can you imagine my wife is actually an Australian resident?

While hitched so you can otherwise defacto with somebody who are a keen Australian resident otherwise permanent resident, you’ve got particular other options. Defacto is described as life together for over 2 yrs.

As mentioned in past times, by having its name into property title, you could potentially avoid the overseas consumer surcharge and you will FIRB acceptance.

not, your parece towards financial title so one another profits is also be used, improving your borrowing from the bank stamina to help you purchase the property you really want.

Exactly what that means would be the fact these firms will certainly see you as a lower life expectancy https://paydayloanalabama.com/underwood-petersville/ risk having more powerful links to help you Australia and will more almost certainly agree you to definitely obtain up to 95% of the house worthy of.

What’s going to along with work with your own go for is when you have been during the a lengthy-label relationships, say 5 years. Having students to one another or you, given that tempory resident, with friends otherwise household members currently located in Australia might works on your favour.

And this work charge sizes will financial institutions give to?

New Australian Authorities will not limitation particular visa items when it comes to borrowing money but not Australian banking companies or other lenders commonly like the less than operating visa sizes:

- Individual Old age Charge (Subclass 405)

- Temporary Organization (Much time Stay) Important Company Sponsorship (Subclass 457)

- International Bodies Service Visa (Subclass 415)

- Home-based Professionals Visa (Subclass 426)

- Diplomats Visa (Subclass 995)

- Physician (Temporary) Charge (Subclass 422)

In particular, we discover of several apps out-of Temporary Company (a lot of time stay) 457 visa owners who had been backed of the its manager and are looking to apply for financing buying a home in australia.

How much out of a deposit do I would like?

The dimensions of your put differ dependent on and therefore state you get in the so if you’re partnered otherwise defacto which have an Australian resident or perhaps not.