The basics of bringing a phrase insurance when you have a mortgage

Financial insurance, payday loans in Fairview Shores FL commonly referred to as home loan insurance coverage, is even more prominent due to the rising worth of attributes all around the country. The majority of people get back home mortgage insurance to guard the upcoming as well as the way forward for their family. You can learn about family mortgage insurance and its masters of the reading post.

Home financing needs a long commitment. Mortgage brokers lasts for to twenty five in order to 3 decades or stretched. Many of us are aware there aren’t any verify notes during the lifestyle. Envision a scenario where in actuality the person who makes the monthly or quarterly EMI payment becomes deceased due to an unforeseeable experiences. Thus, the fresh founded relatives have the effect of settling the loan. The latest house or perhaps the guarantee is taken in the big event that the mortgage is not returned and the instalments aren’t made on time.

In virtually any of these problems, an asset that is beneficial into the household members or that can be taken in a situation from you need is captured as a result of non-payment of the loan’s a great equilibrium. To protect the ones you love and you can family relations in a situation like these, you must bundle in the future. Home loan insurance is now expected, extreme, and also, one can possibly say, extremely important therefore!

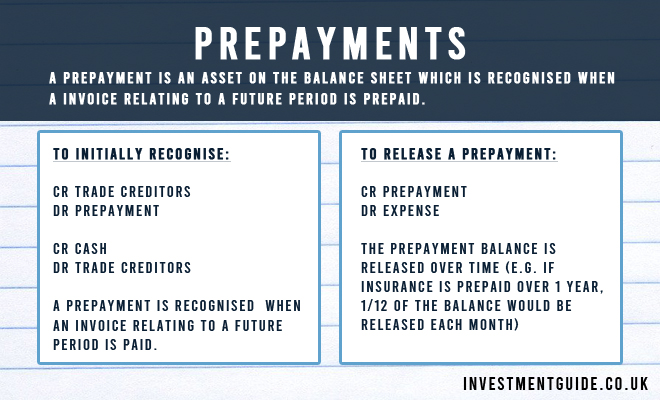

What is mortgage insurance policies?

Quite simply, Home loan Security Bundle (HLPP), referred to as Financial Insurance rates, is a kind of insurance coverage. and that determine one, in the event of brand new borrower’s passing, the insurance company pays the rest balance of the home loan so you can finance companies, NBFCs, or casing fund organizations. Generally speaking, the loan period and the rules label is actually exact same. By obtaining home loan insurance, new debtor try comforted one to though off their otherwise her passage, the new borrower’s family unit members won’t be required to pay-off the borrowed funds or hop out the property due to default towards the financing.

Difference in Home loan Insurance policies and you may Homeowners insurance

Family insurance policies and you can home loan insurance rates are frequently misconstrued by the customers. Both of these concepts is entirely distinct from one another and have now totally different significance.

- House damage due to thievery.

- Destroy away from tragedies caused by character, like earthquakes, storms, flooding, and you may fireplaces.

- Accordingly, homeowners insurance ‘s the brand of insurance one to covers your house’s replacement cost if there is wreck. Financial insurance, not, protects the loan your accept to buy a home. Only the a great loan burden by enough time it absolutely was introduced is covered from this bundle.

More loan providers now want home insurance. Home loan insurance coverage, while doing so, isn’t needed that’s totally up to the latest borrower or applicant with the mortgage.

So why do Loan providers Need Home loan Insurance?

Loan providers do not relish it whenever its money end up being money owed. Obviously they will should continue their money safer. Loan providers wanted financial insurance coverage to prevent financing off are a highly bad personal debt. If for example the borrower passes away, the financial institution will suffer a life threatening economic loss, particularly if these people were the latest family’s only source of income. This is why, real estate loan insurance is best for lenders.

Why do Consumers You would like Home loan Insurance?

As well as currently recognized, if a borrower defaults on their loans, a home mortgage insurance pays the bill of one’s home loan. The new unfortunate passage through of the latest borrower could lead to including a beneficial situation. Home loan insurance is critical for individuals whilst assures one to their dependents won’t be homeless while they’re away or even in an urgent situation.