USDA Fund Had been Minimal Because the 2016

The lender be sure is actually partially funded of the USDA home loan insurance policies advanced, that’s step 1.00% of one’s amount borrowed (). The mortgage has also a great 0.35% annual percentage ().

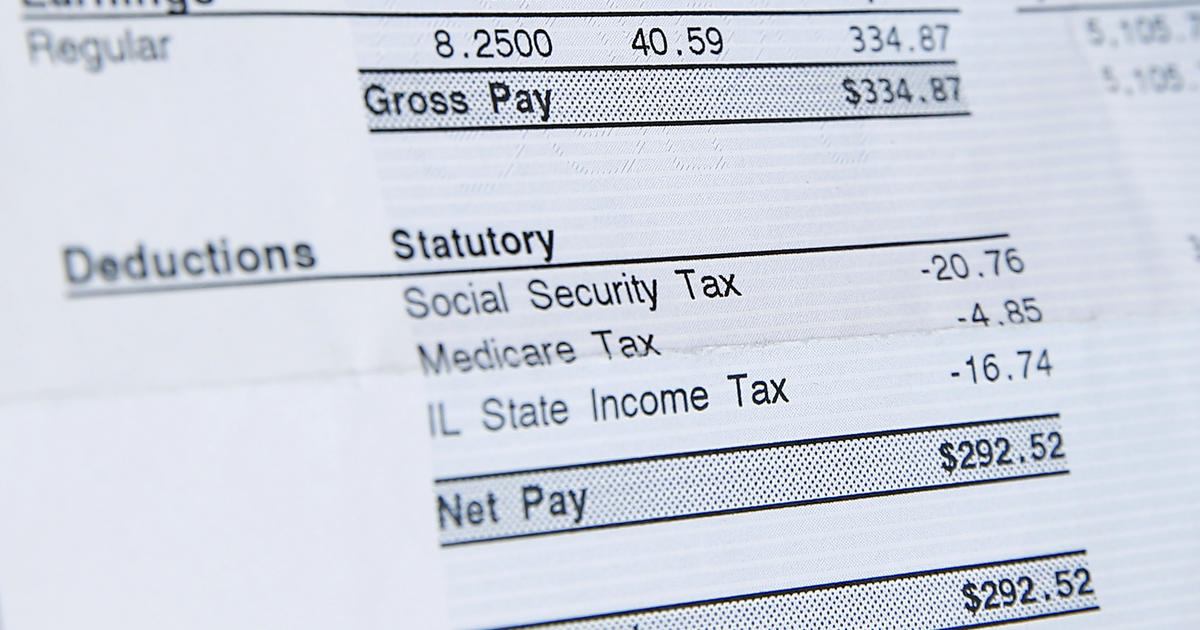

The new annual commission is actually paid down month-to-month from inside the twelve equivalent installment payments. For every single $a hundred,one hundred thousand lent, the fresh upfront fee are $1,one hundred thousand together with monthly advanced was $30.

New borrower can roll new upfront percentage on the amount borrowed or shell out it out-of-pocketpared for other mortgage versions including FHA, or even the personal home loan insurance policies (PMI) to the conventional fund, the new USDA home loan insurance costs are among the lower.

Towards the , USDA quicker their monthly fee from 0.50% so you can 0.35%. Your own month-to-month prices translates to your loan amount or remaining prominent balance, increased from the 0.35%, split because of the twelve.

Additionally, this new upfront percentage fell from 2.75% to just 1.00%. This is an excellent opportunity for home buyers to get down monthly installments using this mortgage program.

USDA Home loan Income Limits

Secured finance are available to moderate earnings earners, that the USDA defines since the those individuals generating up to 115% of area’s median money. For example, children from four to purchase property during the Calaveras State, California can also be secure as much as $ninety-five,450 annually.

It’s also important to keep in mind that USDA takes with the believe all of the money of the home. For example, in the event that a family group with a 17-year-old son having employment would have to disclose the new kid’s income getting USDA qualifications objectives. The latest children’s income doesn’t need to be on the loan application or utilized for degree. Nevertheless the lender will look at all household money when choosing qualifications.

USDA Loan Length

The new USDA mortgage has the benefit of simply a couple of mortgage solutions: 15- and you will 29-year repaired speed fund. They are the safest and more than shown financing programs. Adjustable-rate money commonly readily available.

Reasonable USDA Mortgage Costs

Private banking institutions and you will home loan companies give USDA money during the really low pricing. The newest USDA backs this type of funds, so it is safer and less having personal financial institutions and home loan people to help you give. The new deals is passed on to your house visitors regarding the form of lower cost.

USDA loan pricing are usually below those designed for old-fashioned and you will FHA finance loans for bad credit in Hartford. Homebuyers who choose USDA usually have lower monthly repayments offered large home loan insurance premiums with the most other loan models.

USDA financing allow seller to pay for the newest buyer’s closing costs, around 3% of one’s conversion process rates. Consumers may have fun with current money from family unit members otherwise being qualified non-finances companies so you’re able to counterbalance closing costs when they have this downloadable USDA present page finalized of the donor.

USDA funds as well as create borrowers to open up financing into complete quantity of this new appraised value, whether or not its over the cost. Borrowers may use the excess financing for settlement costs. Such as for example, good house’s price is $a hundred,100000 nevertheless appraises having $105,100. New borrower could open financing getting $105,100 and rehearse the extra fund to finance settlement costs.

Investment Requirements

Consumers who don’t have all their closing costs purchased from the the seller if not you desire dollars to close off the borrowed funds have a tendency to need prove he’s got sufficient assets. A few months financial comments are expected.

Additionally there is a necessity that debtor should not have enough assets to put 20% upon a home. A borrower with plenty of assets in order to qualify for a conventional financing cannot qualify for an effective USDA loan.

Debt Percentages 2020 In order to maintain Changes Folded Out in 2014

Ahead of , there have been zero limit percentages so long as new USDA automated underwriting program, entitled GUS, accepted the borrowed funds. Moving forward, the fresh new borrower need to have rates lower than 31 and you may 41. Which means the newest borrower’s family commission, taxation, insurance policies, and you can HOA dues try not to exceed 31 per cent out of his or her gross income. Additionally, the borrower’s obligations costs (playing cards, auto money, education loan costs, etc) set in the entire domestic fee have to be less than 41 percent of gross monthly money.