What amount of cash return must i discovered towards FHA’s cash-aside re-finance?

An optimum 80% LTV try greet by the FHA when its cash-aside refinance program is used. It indicates a separate financing could be a total of 80% of your own appraised property value your house.

Yet not, your brand-new home loan is required to getting when you look at the loan limitations put because of the FHA. If for example the property value your property has actually significantly enjoyed since you own it, then your number of funds-away could be capped from the financing restrictions set of the FHA.

Maximum restrict to your FHA money in most parts of the fresh nation to possess 2021 is actually $356,362. not, the maximum loan limits on one-tool property can increase to a total of $822,375 from inside the higher-really worth real estate markets for example New york, Ny, and you can Los angeles, California.

Just as much dollars that you will get through using FHA cash-out re-finance would be dependent on brand new guarantee you may have inside your residence.

Keep in mind that 20% of your home’s security should be left as the cash-right back has been taken. Once you are looking at how much you’re able to sign up for. look at the total equity of your house right after which subtract 20% and closing costs to come up with a quotation.

Cost to your FHA cash out refinances

Centered on Freeze Home loan Technical, a loan software providers, new FHA’s fixed prices average as much as 0.10 so you’re able to 0.15% (10 to 15 foundation points) around conventional prices normally. That’s due to the good regulators backing provided by the brand new FHA. These funds can be provided from the lenders at the lower chance. not, FHA mortgage insurance coverage has to be noticed of the borrowers, which advances the effective FHA costs since found below:

FHA cash-out money might have highest rates than the basic FHA loans. For optimum pricing, discuss with various loan providers.

FHA dollars-away against traditional cash-aside re-finance

The largest advantageous asset of having fun with FHA cash-out refinance rather than a traditional dollars-away mortgage is the fact there are many more easy borrowing conditions out of the newest FHA.

Officially, a keen FHA dollars-aside mortgage can be acquired which have a credit rating performing during the five hundred. But not, it is inclined that lenders can begin within 580 to 600, and lots of you will begin on 600. When you yourself have a lesser credit rating, make an effort to become more thorough if you’re appearing for a loan provider who will agree the refinance and gives you a good rates.

Cons on FHA’s dollars-away refinance

Area of the drawback from an enthusiastic FHA dollars-away mortgage ‘s the financial insurance policies associated with the they. One another month-to-month and you can initial financial insurance premiums are needed towards the FHA fund.

- Yearly home loan insurance coverage: 0.85% of yearly loan amount, paid-in 12 installment payments also the mortgage payment

- Initial financial insurance rates: 1.75% of the quantity of the latest loan, paid-up side (always provided included in the mortgage balance)

In exchange for even more charges, far more credit rating liberty is offered by the FHA as compared to old-fashioned loans. There is absolutely no monthly otherwise upfront mortgage insurance policies having old-fashioned cash-aside refinances. Also, FHA are only able to be studied towards the house americash loans Brandon which you live when you look at the, when you’re conventional loans can also be used to have funding qualities and second home.

Pose a question to your financing officer so you can contrast mortgage words and you can choices to ensure you make the best option if you find yourself not knowing from which form of refinance is the best for your unique condition.

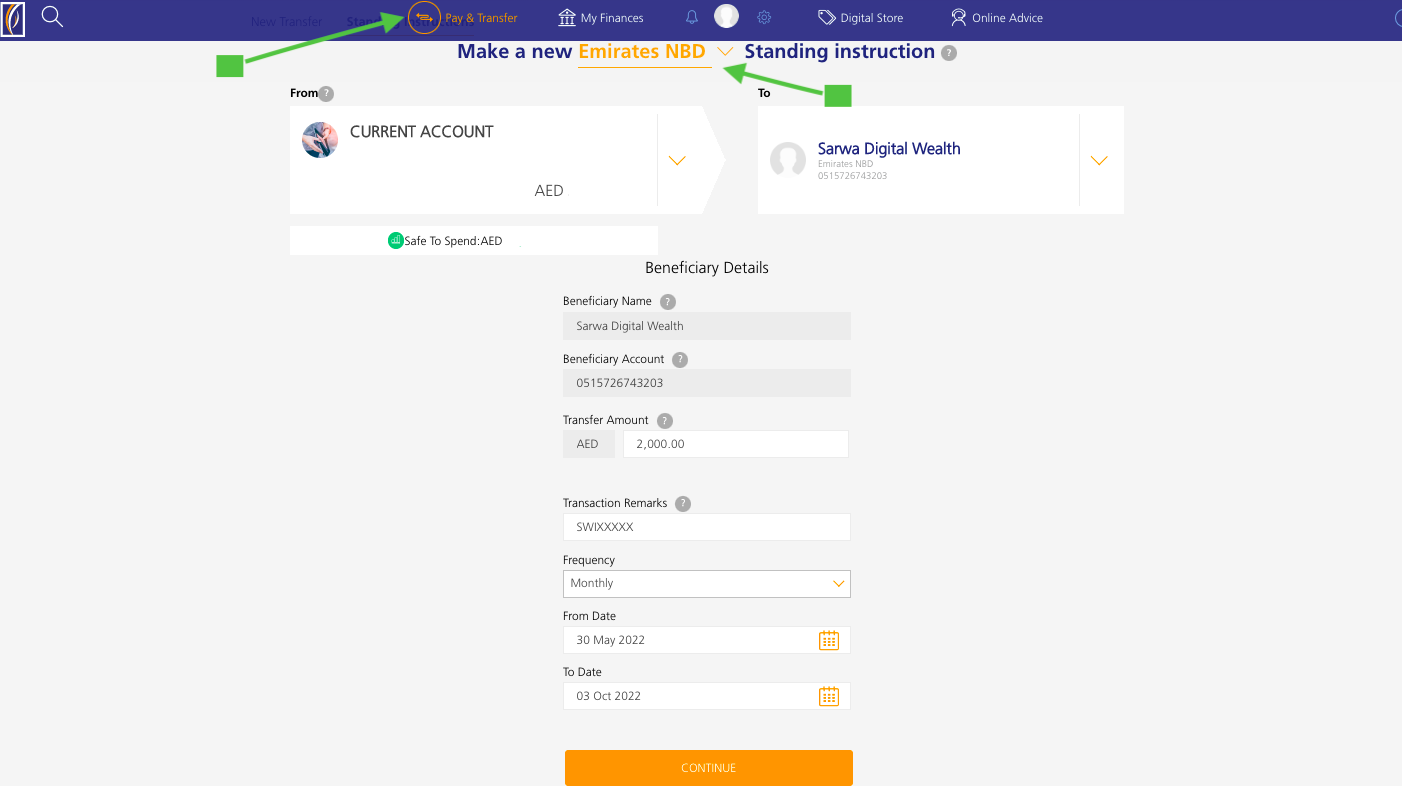

How can i use an FHA bucks-aside refinance

An FHA dollars-out can be used to pay any type of mortgage, as well as have get collateral from your own domestic and also have the money wired for you personally, or perhaps given a. This type of money can be used unconditionally.