What exactly is The lowest Doc Mortgage And you will What exactly are The Professionals?

mortgage

The lowest doc loan was a mortgage that have smaller paperwork required. Its normally considering having consumers that have an excellent borrowing from the bank rating and you will an established money however, may not have a similar amount of bank statements or investment files which can be constantly necessary to get recognized having a traditional mortgage. In this article, we will go through the positives and dangers of this type of mortgage.

Know very well what a low Doctor Loan Are

The financial comments and you will statements having assets called for is lower than just what you’ll need certainly to provide if perhaps you were trying to get a old-fashioned financial. Generally, individuals who might qualify for these types of mortgage tend to be individuals with good credit results and whoever has become efficiently involved in a comparable job otherwise field profession to have at the very least 12 months. If you believe you might be considered but are undecided, try to get advice out of Financing Cycle towards the entire eligibility criteria on loan. Concurrently, borrowers might possibly get approved when they secure in the 20% a lot more as opposed to the full amount that’s required to expend month-to-month on their financial. This needs to be enough evidence one to individuals will be able to pay the money.

What are the Advantages of a decreased Doc Mortgage?

Individuals makes entry to these types of home loan when the they don’t have of several lender statements otherwise investment comments so you can render. Certainly consumers, which have her team might possibly be enough evidence that they’re going to be able to afford the month-to-month repayments and therefore tends to be entitled to a minimal doc financing. Borrowers who do work while the care about-working consultants, freelancers, and those with other sources of earnings can take advantage of such as for example mortgages too.

An alternative work with included in this form of financial ‘s the reduced recognition big date. Recognition might also believe regardless if you are utilized by a firm otherwise mind-operating as mentioned prior to. Things such as your credit rating and you may yearly earnings have a tendency to connect with your ability to track down approved for the lowest doctor financing.

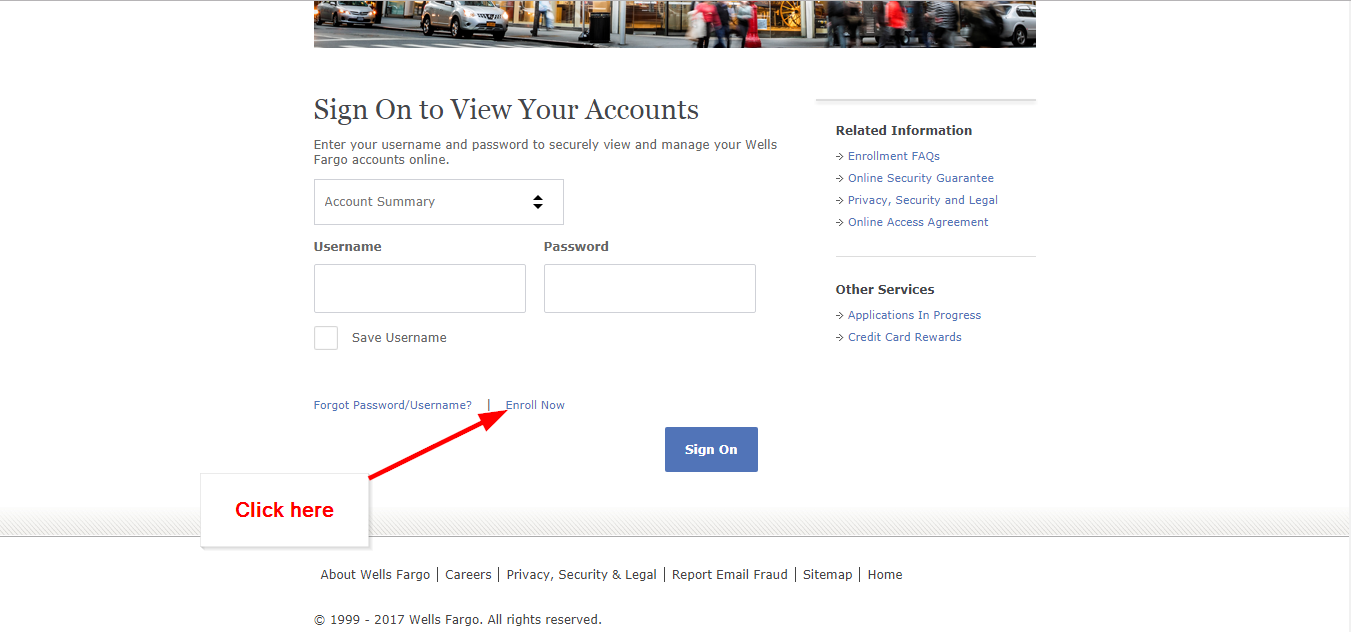

Simple tips to Sign up for a minimal Doc Mortgage

Just like the mortgage market is becoming more and more competitive, it isn’t a simple task to acquire approved for a loan. A minimal doctor loan might be the respond to you are looking for should this be correct for your requirements.

- The house or property can be used as shelter on your own home loan

- It will be the latest otherwise mortgaged up against another type of present possessions

- One candidate need to have stored its full-day a career for around 3 years

A lower life expectancy number of documents requisite mode the Hamilton GA bad credit loan lender requires less facts about the money you owe. This really is of good use if you are worry about-functioning or has actually changing income because of fee, incentives if you don’t implementing an irregular basis.

Autonomy

The main benefit of these types of home financing try independency. If you do not have the expected documents and do not meet the requirements having a normal deal, in that case your simply most other choice is so you’re able to acquire of a unique provider, such family unit members or nearest and dearest. These types of loan might be perfect for individuals who are self-employed or possess regular work that fluctuate their earnings more than the course out-of annually. At exactly the same time, individuals having an educated and you can experienced broker could discuss the fresh new correct price.

Dangers to take on

As with any financing, discover threats to adopt once you get a low doctor mortgage. Such as for example, specific lenders will allow you to obtain doing 80 per cent of property’s well worth, which is less than a good number of old-fashioned mortgages make it. In addition will be billed highest rates of interest than just with other kind of fund. However, in the event the credit ratings are great and you have adequate coupons to put down an acceptable put toward a home, this type of loan is exactly what need.

If you’re down paperwork funds could be extremely convenient for borrowers with good credit scores and a professional income, for folks who use more 80% of one’s property’s really worth then there could also be most costs that will use. Extra rates of interest may also use when credit more than 90%. If this is happening, it is vital to thought if these types of money carry out produce economic problems afterwards because you might end right up trying to repay several thousand dollars more required.

When you yourself have good credit and a stable money however, do not have the paperwork, this may be could well be value looking for a loan provider which also provides this type of financing. Although not, in advance of investing in anything, be sure to know the small print you to definitely commonly apply.