Whether your home mortgage try kept otherwise serviced because of the a new York-regulated place, it’s also possible to qualify forbearance

Down load a good PDF Type

- What exactly are my solutions if i try not to make my personal monthly financial repayments?

- What is actually Forbearance?

- What happens in the event that forbearance ends?

- How do i know if loans in Baileyton with bad credit or not You will find good federally backed financial?

- Have there been additional options along with forbearance preparations?

- When can be my financial begin a foreclosures action?

- I have a public auction big date arranged. Just what can i expect?

- Just before , I received good Summons and you may Criticism or other data you to definitely state I must address otherwise are available in courtroom. Just what ought i manage?

- I have a face-to-face home loan. Exactly what can i perform if i am unable to shell out my personal assets fees?

- Where can i find out more about apps to help individuals by way of anyone health disaster?

What exactly are my personal possibilities basically do not generate my personal month-to-month financial costs?

If you have sustained pecuniary hardship once the beginning of the COVID-19 pandemic, you are almost certainly entitled to forbearance to make mortgage repayments for around 360 months.

Very homeowners enjoys federally backed mortgage loans. If you find yourself one of them, it’s also possible to ask your servicer to possess an excellent forbearance as high as 180 months. The newest forbearance is prolonged to possess an additional 180 weeks.

If your mortgage isnt federally backed and never maintained because of the a nyc-managed entity, you may still find a forbearance, although duration and you can terminology is put of the entity servicing the mortgage. It could be best if you questioned good forbearance written down, explain it is regarding the public fitness disaster, and sustain a copy of your page and proof delivering (whether by the post, facsimile, or email).

When your financial refuses to leave you forbearance get in touch with Nassau Suffolk Law Attributes at the (631) 232-2400 (Suffolk) or (516) 292-8100 (Nassau), a different legal advice supplier, a non-earnings houses counselor, or perhaps the Nyc State Attorney General’s place of work from the step 1-800 771-7755.

What’s Forbearance?

Forbearance waits the newest deadline for the home loan repayments. Forbearance is not forgiveness. Youre still guilty of money missed from inside the forbearance.

Both government CARES Work and you can New york County Law introduced in response so you’re able to COVID-19 ban later charge and fees not in the notice determined since the if your repayments were made on time. Forbearance preparations perhaps not subject to the fresh CARES Work otherwise NYS laws range between later charge and extra attention costs.

Escrow charges for possessions taxation and you may/or possessions insurance are not subject to forbearance. In the event property charge might not be due for a few days after the brand new forbearance months begins, home loan servicers are required to be certain that there was adequate on your own escrow account about entire season and may need continued payment of one’s taxation and you will/otherwise insurance rates part of the month-to-month mortgage payment during the forbearance period.

What takes place when the forbearance closes?

Homeowners having federally backed mortgage loans and people maintained by NYS managed establishments have the option to decide whether to expand the loan name towards amount of new forbearance months (adding the amount of months of your forbearance towards end of your loan identity), decide to spread forbearance costs on a monthly basis to the leftover mortgage title, or expose a non-appeal hit balloon commission at the conclusion of the borrowed funds term towards forbearance number.

How to learn if You will find a good federally backed mortgage?

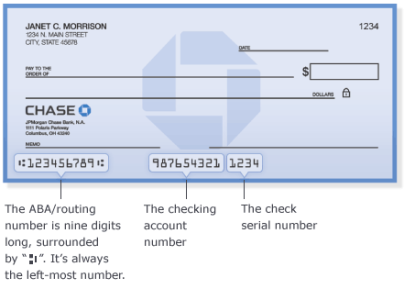

Extremely federally-backed mortgage loans was belonging to Fannie mae or Freddie Mac, guaranteed otherwise insured because of the HUD (FHA), or the Virtual assistant. Fannie mae and you can Freddie Mac possess on the web mortgage lookup-upwards products to own home owners knowing if or not both of those bodies-paid agencies already possesses the loan.