You would like a little let financing a tiny domestic? We now have alternatives

Since june regarding 2014, the subject of small homes has actually quickly gained popularity, particularly in this new You.S. Out-of television shows so you can smaller household communities , the little domestic way is and make a massive disturbance throughout the housing marketplace. However, at the rear of most of the little homeowner’s dreams of liberty, lifestyle a simple existence, and you will improving the environment happens a far more big question: how do you finance a tiny house?

Ought i sign up for a mortgage for my little family?

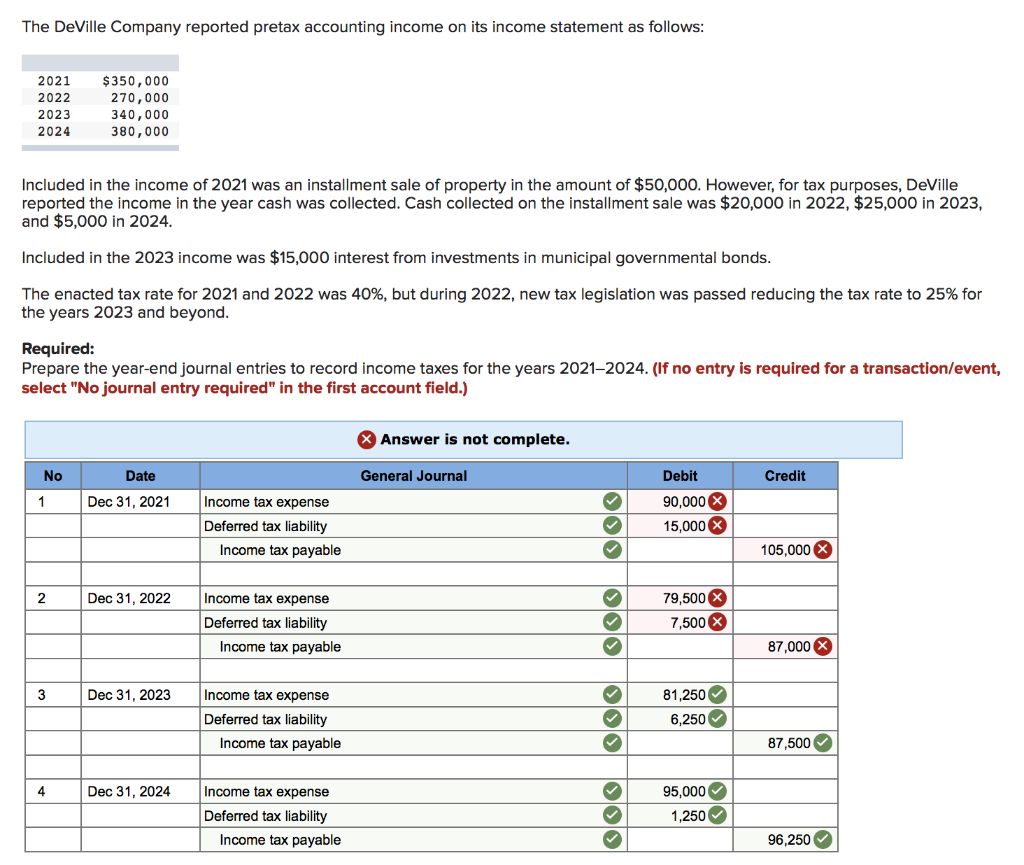

In a nutshell, yes. While you are conventional lending options to possess small households was basically scarce from the previous, Cardinal Financial has the benefit of Conventional resource to own little home, basket residential property, or any other comparable qualities. Here is the connect. The only way to score a traditional financial to possess a little home is if it is built on a foundation-it cannot be mobile.

If it is mobile, it’s not noticed real property, hence, it will not be eligible for a vintage financial. Aside from that, if for example the possessions matches all the relevant assessment conditions along with your borrowing score was over 620, you should be all set. We’ll including take on off repayments only 3%, if you get a hold of a tiny house in your future, there clearly was a high probability you’ll be able to loans you to that have us.

If you are antique lending products to have smaller households was in fact scarce regarding early in the day, Cardinal Financial offers Old-fashioned capital to possess small home, container land, and other comparable services.

Home improvement

While the smaller house is somewhat cheaper than traditional residential property into the sector, its safer to express you might most likely put together investment your self. For those who already have a primary residence and you are clearly perhaps not into the a hurry to maneuver, loans Simsbury Center CT a choice may be to build your latest way of living disease act as much time that one can and you may save up at that moment. After that, when the time comes to invest in your own lightweight house, you might pay entirely out of your offers. While this means takes more than other choices, the bonus is getting into their small family personal debt-totally free! That’s some thing old-fashioned people are unable to tout.

Acquire of relatives and buddies

If you’re someone who has big friends which help the lightweight family desires, it would be worth it to inquire about them to have money! Professionals are priced between: It’s not necessary to cover a financial institution. You’re able to influence the latest pay schedule that have somebody you know really and you may faith. You could potentially also be capable use in place of interest. Essentially, the two of you can make your own legislation, so long as the fresh new agreement is reasonable and you will does not log off either one of you in the economic straits.

If you find yourself somebody who has good friends and family whom help your little house dreams, it might be worth it to inquire of all of them to own money!

Peer-to-fellow credit

One of the coolest aspects of the little family way are which most feels as though a community. So it spirits concerns lives owing to fellow-to-fellow financing web sites in which potential tiny homeowners have access to money and get linked to third-party lenders. Typically, these firms is dealers just who truly want to help tiny property owners achieve their small life goals and are usually supportive of one’s larger-visualize lightweight household direction. How cool would be the fact?!

Other sorts of funds

Secure Financing: Secured personal loans is tethered so you’re able to possessions. It indicates you could borrow funds out-of a protected resource, particularly collateral on your top residence, an alternate possessions, otherwise a paid-out of automobile. Having a protected financing, you could borrow money up against your property and make use of that money to invest in their smaller household.

Consumer loan: In place of secured loans, unsecured loans are not linked to some assets. You could borrow an unsecured loan from your bank once they influence which you have qualifying borrowing from the bank.